About Us

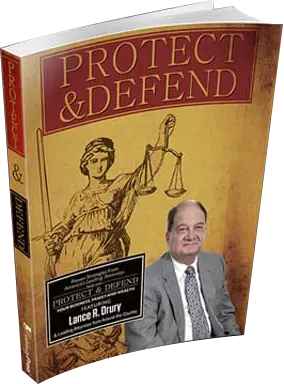

Meet Tax Attorney Lance R. Drury

A Strong Advocate In Complex State And Federal Tax Law Matters

At The Law Office of Lance R. Drury, we represent clients in a wide array of tax law matters. Our founding attorney, Lance Drury, has been practicing law in Missouri since 1984.

We are prepared to represent you in any tax law matter, including:

- Tax planning services

- Litigation of disputes

- Tax resolutions

Dedicated Representation From A Respected Tax Lawyer

When you choose The Law Office of Lance R. Drury, you get more than the experience of a respected tax law attorney whose work has been recognized nationwide. You also get the support of a dedicated team that works together in pursuit of the best outcome available for your case.

Since 2006, The Law Office of Lance R. Drury has been representing individuals and businesses in disputes with the Internal Revenue Service and Missouri State Tax Commission. Located in Ste. Genevieve, Missouri, we’re proud to offer experienced tax services in Missouri and across the nation.

We take every client’s unique situation and provide them with honest answers and a plan on how to resolve their problems.

To do this, we’ve developed and followed an Eight Point Plan to resolve your IRS tax problems:

1. We will meet with you and thoroughly discuss your tax situation.

It is important that we obtain a thorough understanding of your unique tax issues. This personal interview will provide us with the background needed to develop the appropriate strategy for solving your IRS tax problems.2. We will prepare a power of attorney for you to sign.

With the power of attorney, we put the IRS on notice that we are representing you. All future telephone calls from the IRS should come to us and not you.3. We will obtain transcripts of your accounts from the IRS.

By reviewing your IRS transcripts, we will be able to accurately determine what the IRS thinks it knows about your tax situation.4. We will develop the appropriate strategy for solving your IRS tax problems.

Every taxpayer’s situation is unique. With the information you have provided, we will develop a strategy to get the lowest possible settlement allowed by the law.5. We will send you an easy-to-follow checklist of additional information you need to provide.

Preparing complicated IRS forms is our business. You, however, will have to provide us the information needed to complete these IRS forms. We will make this process as easy as possible by sending you our easy-to-follow checklist.6. We will prepare all forms required by the IRS to resolve your IRS tax problems.

We will prepare all forms required by the IRS. All you have to do is review these forms and sign them. We take care of the rest.7. We will negotiate with the IRS.

In order to obtain the lowest possible settlement allowed by the law. We will handle all negotiations with the IRS in order to get you the best deal possible.8. We will thoroughly discuss all aspects of your settlement with you.

We will explain all aspects of your settlement with you and answer any and all questions you may have. We want to make sure you are completely satisfied.

Learn More About Our Tax Law Services And How We Can Help You

Contact our office to schedule a free, confidential consultation regarding your tax law issue. We will provide a thorough assessment of your situation and offer our best recommendation about how to proceed. Please call one of our offices, or contact us via email to schedule an appointment.

Ste. Genevieve, (573)-883-3056; St. Louis, (314)-260-6120; Nashville, (615)-733-8168; and San Antonio, (726)-202-1300.

“The choice of a lawyer is an important decision and should not be based solely upon advertisements.”

Lance

Call Us Now

Call Us Now Email Us Now

Email Us Now